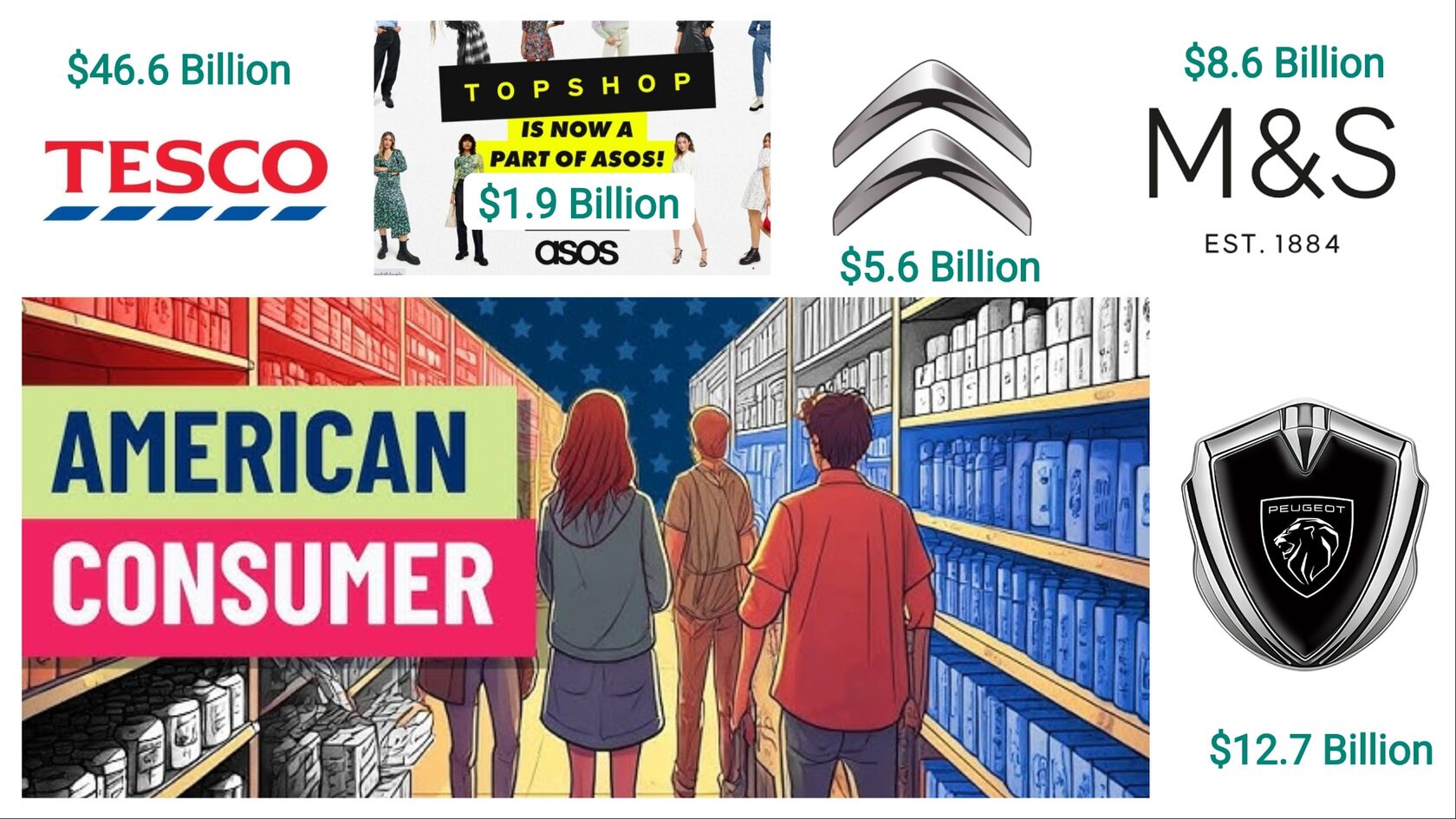

The United States, often seen as the ultimate prize for global brands, has also been a graveyard for some ambitious international companies. Success at home or in other markets does not always guarantee American triumph. Cultural differences, misjudged strategies, and fierce competition have led even iconic brands to stumble. Here’s a closer look at five notable brands—Citroën, Peugeot, Tesco, Marks & Spencer, and Topshop—and why their attempts to conquer the US market failed.

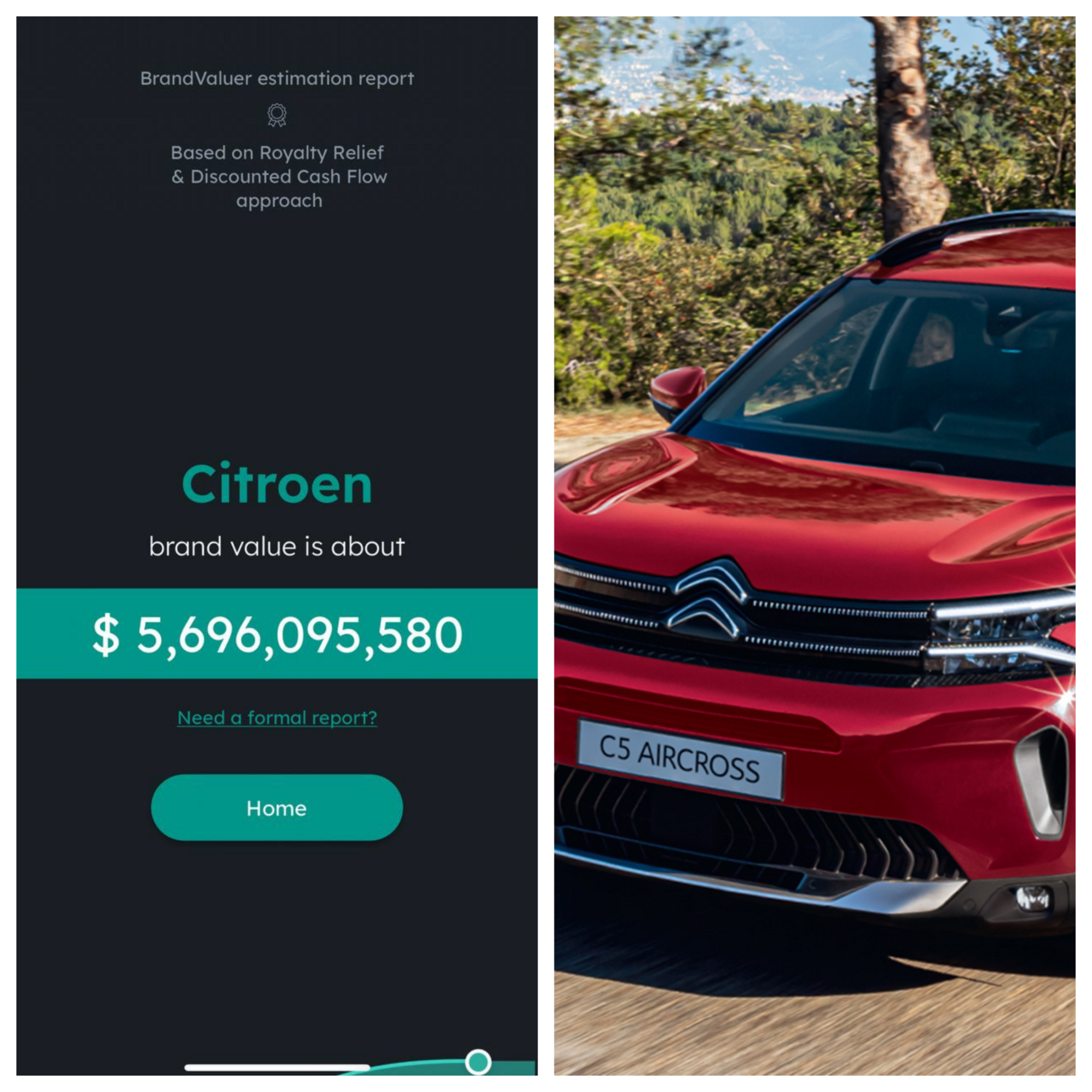

Citroën: The Quirky French Automaker

Citroën, known for its innovative designs and advanced technology, entered the US market in the mid-20th century. The brand’s cars—like the DS with its hydropneumatic suspension—were engineering marvels. However, American consumers found Citroëns to be strange, expensive to maintain, and poorly suited to local tastes and driving habits.

Citroën struggled with limited dealership networks and weak parts availability. In 1974, after a decade of mounting losses and increasing regulatory challenges (like stricter US safety standards), Citroën officially withdrew from the American market. Today, the brand still does not sell cars in the US.

Current Revenue: Citroën reported net revenues of $16.1 billion in 2024.

Lesson: Technical innovation alone doesn't guarantee success—products must also fit local consumer expectations and infrastructure.

According to the BrandValuer app, Citroen’s brand is worth an estimated $5.6 billion.

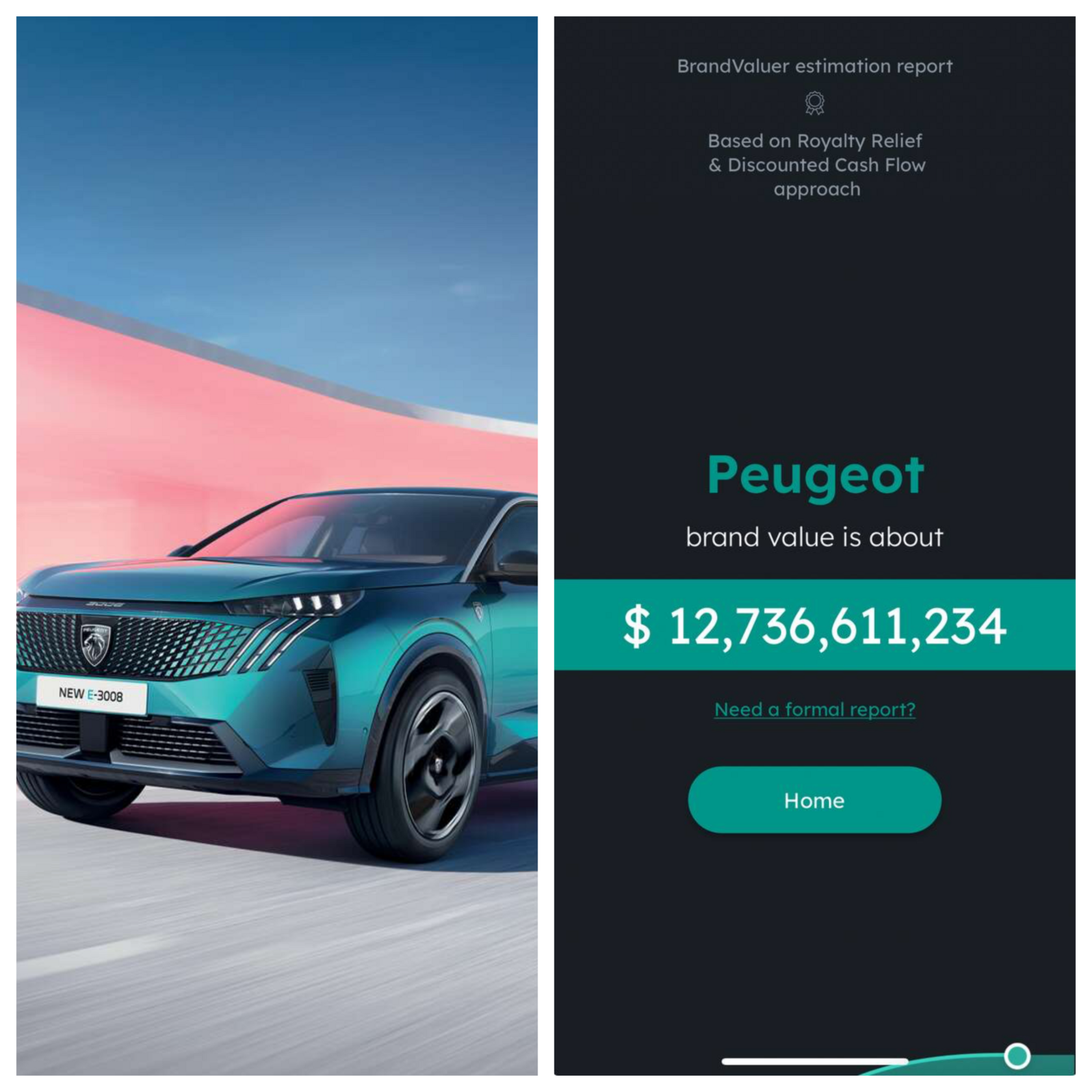

Peugeot: A Tale of Poor Timing and Quality Issues

Peugeot’s story in the US is similarly cautionary. Although Peugeot had a presence in the US as early as the 1950s, the 1980s proved disastrous. The brand suffered from reliability issues, a poor reputation for quality, and a lack of strong marketing to differentiate itself from better-known European competitors like BMW and Mercedes-Benz.

Peugeot's models were perceived as underpowered and overpriced compared to American and Japanese rivals. Facing plummeting sales and high operational costs, Peugeot exited the US in 1991. Although Stellantis has announced plans for a potential return, it remains a daunting task.

Current Revenue: Peugeot reported net revenues of $36 billion in 2024.

Lesson: Brand image and product reliability are critical in a crowded, competitive market.

According to the BrandValuer app, Peugeot’s brand is worth an estimated $12.7 billion.

Tesco: Grocery Giant, Strategic Misstep

Tesco is one of the largest retailers in the UK and globally. But when it launched its "Fresh & Easy" stores in the US in 2007, things quickly unraveled. Tesco misread American shopping habits, offering smaller stores with prepackaged meals—aimed at time-poor shoppers—while most Americans preferred larger supermarkets and fresh produce options.

Additionally, Tesco chose locations without enough market research, often setting up stores where there was little demand. Cultural disconnects, combined with the 2008 financial crisis, led to mounting losses. By 2013, Tesco had pulled out, costing the company around $2 billion.

Current Revenue: Tesco reported revenues of $86 billion for 2024.

Lesson: Deep understanding of local consumer behavior is essential before entering a new market.

According to the BrandValuer app, Tesco’s brand is worth an estimated $46.6 billion.

Marks & Spencer: Failing to Translate British Appeal

Marks & Spencer, a beloved British department store, attempted to expand into the US in the late 1980s by purchasing the upscale retailer Brooks Brothers and later launching its own stores. However, M&S struggled to translate its British appeal to American consumers. The merchandise failed to connect, stores felt uninspired, and the brand's identity seemed muddled.

Competition was fierce, and M&S couldn’t carve out a distinctive niche. By 2001, Marks & Spencer had exited the US market completely, selling off Brooks Brothers and closing its standalone stores.

Current Revenue: Marks & Spencer reported revenues of $16.3 billion for 2024.

Lesson: Brand identity needs to be both clear and adapted appropriately to the target market.

According to the BrandValuer app, Marks & Spencer’s brand is worth an estimated $8.6 billion.

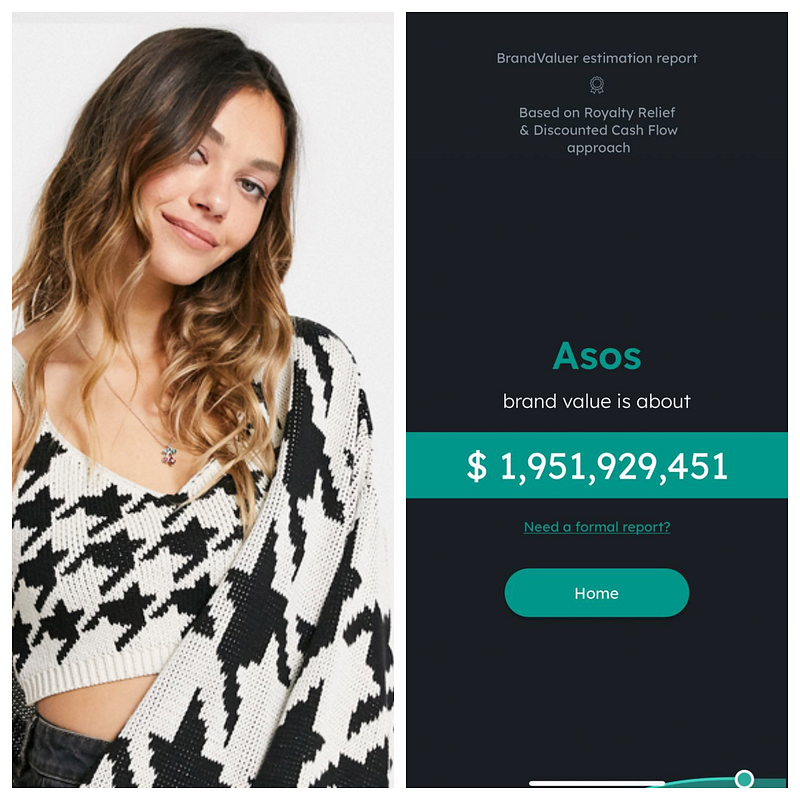

Topshop: Trendy Fashion, Tough Timing

Topshop, the trendy British fast-fashion retailer, enjoyed cult status at home and initially generated a lot of buzz when it opened stores in the US, including a high-profile New York flagship in 2009. Yet, despite early excitement, Topshop struggled to maintain momentum.

The rise of online shopping, fierce competition from brands like Zara, H&M, and later homegrown brands like Fashion Nova, hurt Topshop’s physical retail strategy. Furthermore, Topshop’s higher price points in the US (compared to its UK prices) alienated young shoppers looking for budget-friendly fashion. In 2019, Topshop filed for bankruptcy in the US and closed its stores.

Current Revenue: Topshop's parent company, Arcadia Group, went into administration in 2020. Topshop was subsequently acquired by ASOS in 2021. In 2024, ASOS brought in $3.8 billion in revenue.

Lesson: Timing and flexibility are critical in fast-moving retail sectors.

According to the BrandValuer app, ASOS’ brand is worth an estimated $1.9 billion.

Conclusion

Each of these brands—Citroën, Peugeot, Tesco, Marks & Spencer, and Topshop—brought strong reputations and ambitious plans to the US, yet fell victim to various missteps. Their stories serve as important reminders that entering the American market demands more than name recognition: it requires an intimate understanding of local culture, consumer expectations, competition, and timing. In the land of opportunity, even giants can falter if they misread the playing field.