In 2024, the global gold market experienced a major rally, with prices soaring by 23% to approximately $2,748 per ounce. Amid economic instability, inflationary concerns, and geopolitical uncertainty, demand for gold surged—benefiting the industry's biggest players. Through acquisitions, efficiency improvements, and aggressive expansion, these companies consolidated control over a larger share of global gold production.

Newmont Corporation (USA)

2024 Revenue: $12.8 billion

Production: 215.6 tons

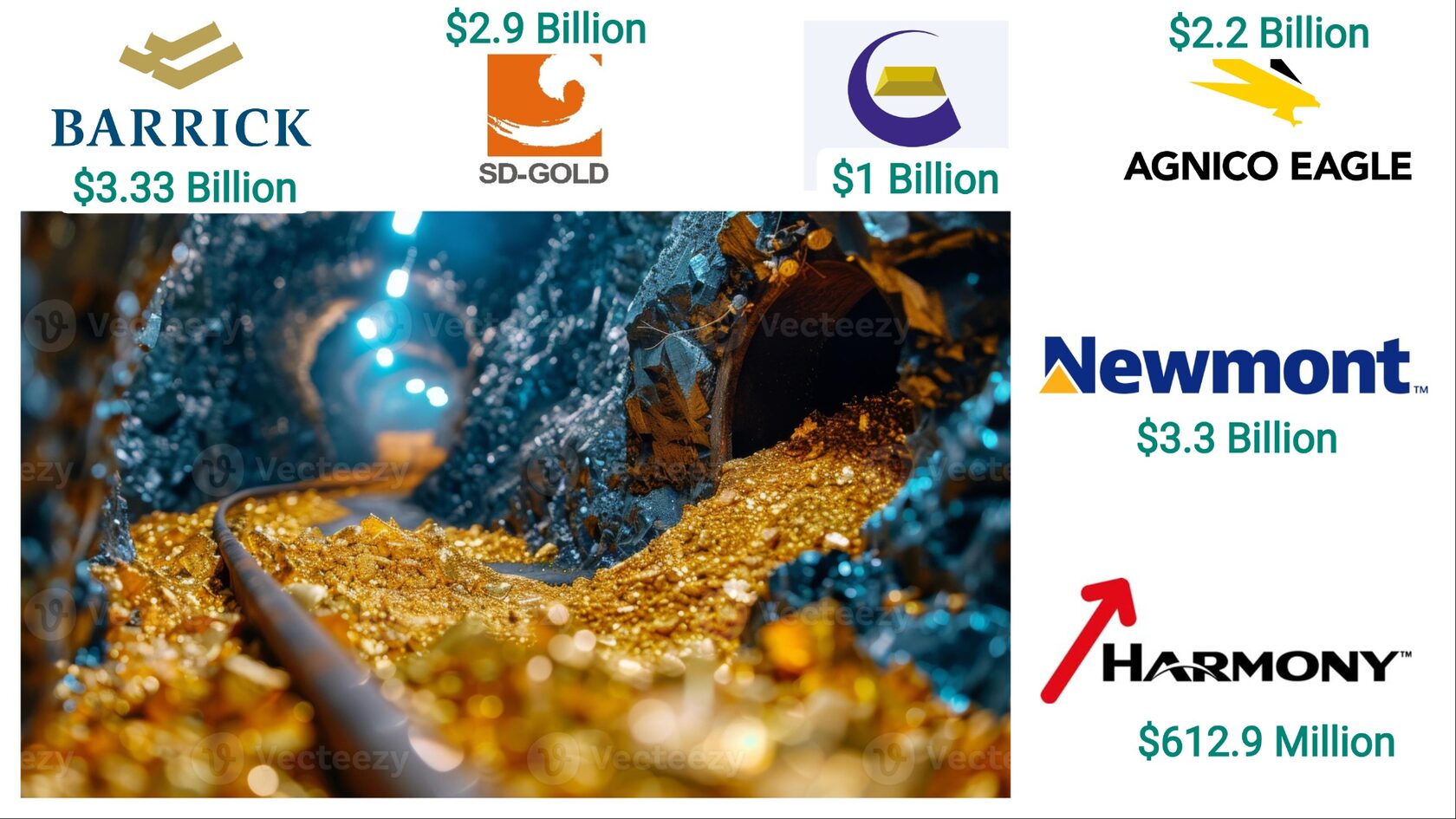

Highlights: Newmont secured its position as the world’s largest gold producer after acquiring Newcrest Mining for $16.8 billion. The merger significantly expanded its reserves and operational reach. According to the BrandValuer app, Newmont Corporation’s brand is worth an estimated $3.3 billion.

Barrick Gold Corporation (Canada)

2024 Revenue: $12.922 billion

Production: Approximately 121.6 tons

Highlights: Barrick continued to post strong earnings, leveraging favorable market prices despite minor operational challenges across its portfolio. According to the BrandValuer app, Brick Gold Corporation’s brand is worth an estimated $3.33 billion.

Agnico Eagle Mines Limited (Canada)

2024 Revenue: $8.64 billion

Production: Approximately 107.3 tons

Highlights: Agnico Eagle reported record quarterly profits thanks to optimized operations, strong performance in Canadian mines, and its strategic merger with Yamana Gold. According to the BrandValuer app, Agnico Eagle Mines Limited’s brand is worth and estimated $2.2 billion.

Shandong Gold Group (China)

2024 Revenue: $11.55 billion

Production: Not publicly disclosed

Highlights: A leader among China’s state-backed gold producers, Shandong Gold made significant international acquisitions, extending its presence in Africa and Latin America. According to the BrandValuer app, Shandong Gold Group’s brand is worth an estimated $2.9 billion.

Zhongjin Gold Corporation (China)

2024 Revenue: $3.99 billion

Production: Not specified

Highlights: The company emphasized sustainability in its extraction processes while expanding its operational base within China and abroad. According to the BrandValuer app, Zhongjin Gold Corporation’s brand is worth an estimated $1 billion.

Harmony Gold Mining Company Limited (South Africa)

2024 Revenue: $2.47 billion

Production: Not specified

Highlights: Harmony boosted production in South Africa and increased its investments in Papua New Guinea, focusing on modernization and environmental compliance. According to the BrandValuer app, Harmony Gold Mining Company’s brand is worth an estimated $612.9 million.

Strategies Behind Market Domination

Strategic Mergers and Acquisitions

Industry consolidation played a major role in reshaping the gold landscape. Newmont's acquisition of Newcrest and Agnico Eagle's merger with Yamana exemplified how strategic deals are being used to unlock scale and diversify asset portfolios.

Operational Efficiency

Efficiency became a crucial driver of profitability in 2024. Agnico Eagle, in particular, used optimized mining operations to significantly increase margins, translating higher gold prices into stronger earnings.

Global Expansion

Chinese companies like Shandong Gold and Zhongjin Gold invested in overseas projects, positioning themselves as emerging global contenders in the traditionally Western-dominated gold industry.

Innovation and ESG Investment

Leaders in the gold sector are increasingly prioritizing environmental, social, and governance (ESG) initiatives. From automation to cleaner extraction methods, companies are leveraging new technologies to stay compliant and competitive in global markets.

Outlook: What’s Next for the Gold Titans?

With rising demand from central banks, investors, and industrial applications, the future of gold remains bullish. The companies that led in 2024 are expected to:

Expand exploration into underdeveloped gold regions

Invest in green mining technologies

Maintain strong capital reserves to weather commodity cycles

Their ability to adapt to both geopolitical and environmental pressures will determine who dominates the next phase of gold’s global story.