The gas station and convenience store industry in the United States is a highly competitive market, with several major brands vying for dominance. While each brand has its unique strengths, factors such as revenue, customer loyalty, store experience, and geographic reach determine their overall market influence.

QuikTrip Corporation

Revenue: Around $20.3 billion in 2023.

Overview: Established in 1958, QuikTrip manages more than 1,000 convenience stores and gas stations across 17 states, primarily in the Midwest, South, and Southwest.

Strengths: QT is expanding aggressively in the Southern and Midwestern U.S. with a reputation for clean stores, fast service, and quality food.

Challenges: Similar to Wawa and Sheetz, QT focuses on urban and suburban markets rather than massive travel center-style locations.

According to the BrandValuer app, QuikTrip Corporation’s brand is worth an estimated $9.5 billion.

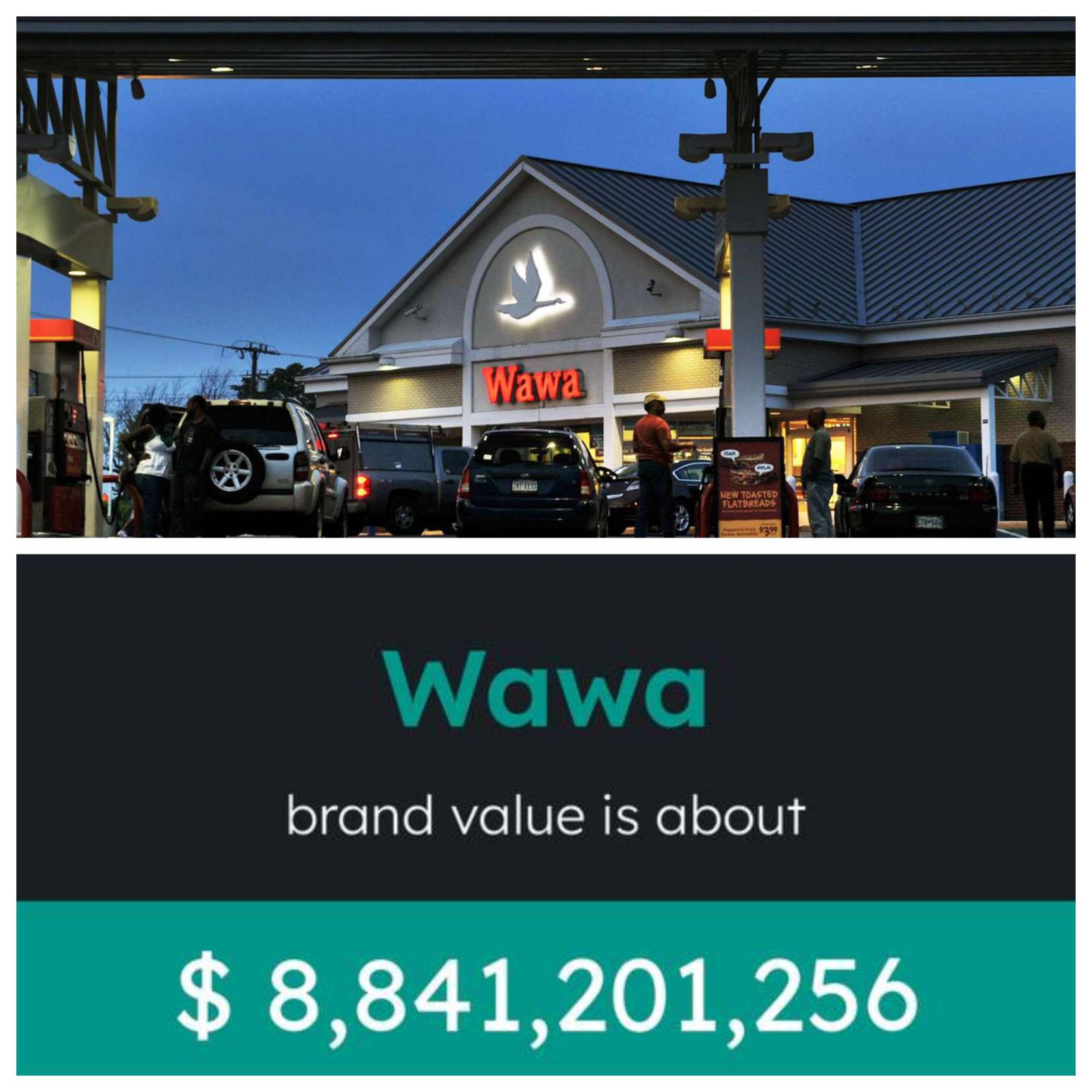

Wawa Inc.

Revenue: Approximately $18.9 billion in 2023.

Overview: Since its inception in 1964, Wawa has expanded to about 1,000 convenience stores throughout the Northeast and Florida, offering a range of fresh food and beverage options alongside fuel services.

Strengths: Wawa has a strong brand identity, particularly in the Mid-Atlantic and Florida, offering high-quality fresh food, coffee, and competitive fuel prices. It has a strong cult following similar to Buc-ee’s, though its locations are significantly smaller.

Challenges: Wawa’s stores are not nearly as large as Buc-ee’s, nor do they focus on highway mega-locations with the same scale.

According to the BrandValuer app, Wawa Inc.’s brand is worth an estimated $8.8 billion.

Sheetz Inc.

Revenue: Around $14 billion in 2023.

Overview: Founded in 1952, Sheetz operates approximately 680 stores across Pennsylvania, Maryland, Ohio, Virginia, West Virginia, and North Carolina, known for their made-to-order food and 24/7 service.

Strengths: Like Wawa, Sheetz has a devoted customer base, particularly in the Northeast and Midwest, with a focus on made-to-order food and a convenience-driven experience.

Challenges: Store sizes are more compact compared to Buc-ee’s, and the brand lacks the massive retail component that defines Buc-ee’s.

According to the BrandValuer app, Sheetz Inc.’s brand is worth an estimated $6.4 billion.

Love's Travel Stops & Country Stores

Revenue: Approximately $26.5 billion in 2023.

Overview: Founded in 1964, Love's operates over 640 locations across 42 states, offering fuel, convenience items, and services tailored for both professional drivers and travelers.

According to the BrandValuer app, Love’s brand is worth an estimated $12.3 billion.

Pilot Travel Centers (Pilot Flying J)

Revenue: $6.3 billion in 2023.

Overview: As a major player in the travel center industry, Pilot Flying J offers extensive services for both professional drivers and casual travelers across North America.

Strengths: These truck stop giants dominate the interstate fuel and convenience market, offering food, showers, and large-scale operations.

Challenges: They cater to truckers more than casual travelers, and their atmosphere lacks the family-friendly appeal of Buc-ee’s.

According to the BrandValuer app, Pilot Flying J’s brand is worth an estimated $2.9 billion.

Buc-ee’s

Buc-ee’s doesn’t just build gas stations—it builds travel centers. Unlike the cramped, dimly lit convenience stores attached to most fueling stations, Buc-ee’s locations are sprawling, often covering tens of thousands of square feet. Some of its largest stores boast over 100 gas pumps and enough parking to accommodate road-trippers, RV travelers, and semi-truck drivers alike. In 2023, Buc-ee’s brought in $2.5 billion in revenue. According to the BrandValuer app, Buc-ee’s brand is worth an estimated $1.2 billion.

The Verdict: Who Dominates?

Each brand excels in different areas, but Love’s Travel Stops leads in sheer revenue and national reach. However, for customer experience and cult-like following, Buc-ee’s holds a unique position. For fresh food and convenience, Wawa and Sheetz take the crown in their respective regions, while QuikTrip remains a strong competitor in the Midwest and South.

Ultimately, the "dominance" of a brand depends on the criteria used—whether it’s revenue, customer satisfaction, or store experience. Buc-ee’s may not have the largest revenue yet, but its aggressive expansion and unmatched store experience make it a formidable competitor in the gas station industry.