In a dramatic shift within the electric vehicle (EV) industry, Chinese automaker BYD (Build Your Dreams) has not only caught up to but surpassed global giants Tesla and Ford in the EV race. Once considered a regional competitor, BYD has now cemented its place as a global force, causing concern among the traditional powerhouses of the automotive world.

BYD’s Meteoric Rise

In 2024, BYD sold a staggering 4.27 million vehicles, more than doubling Tesla’s 1.79 million deliveries. This sales surge helped BYD achieve a revenue of $107 billion, surpassing Tesla’s $97.7 billion. The company’s growth is fueled by a broad range of affordable EVs and hybrids, particularly appealing to cost-conscious buyers in China—the world’s largest auto market—and increasingly in Europe and Latin America.

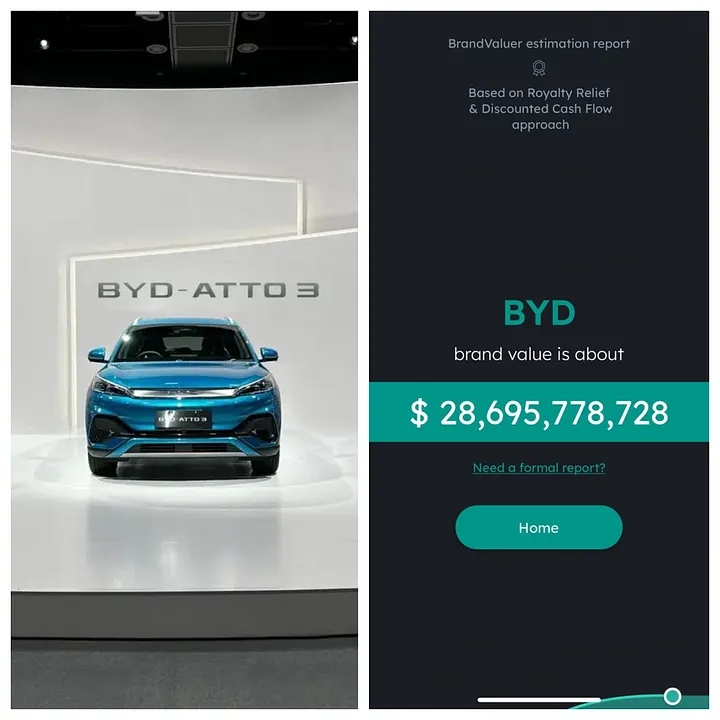

Unlike many of its rivals, BYD doesn’t rely solely on high-end models or flashy marketing. Instead, it’s offering practical, well-built EVs like the Dolphin, Atto 3, and Seal that provide real value and reliability. In 2024 BYD brought in $80 billion in revenue. According to the BrandValuer app, BYD’s brand is estimated to be $28.6 billion.

Tesla’s Waning Grip

For years, Tesla dominated the global EV market. But in recent quarters, cracks have started to show:

- Tesla’s U.S. sales dropped 8.6% in Q1 2025.

- Its EV market share in the U.S. fell from 51% to 44%.

- In Europe, sales declined a dramatic 43% in early 2025, attributed in part to political backlash against CEO Elon Musk.

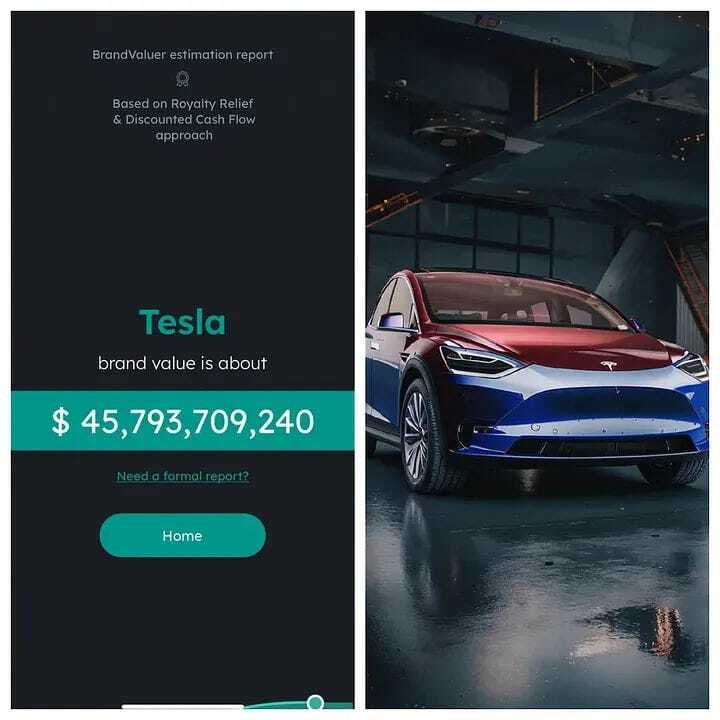

Additionally, Tesla’s aging vehicle lineup, production delays, and increasing consumer skepticism are chipping away at its once untouchable brand. While it still enjoys strong brand recognition, Tesla’s position as the undisputed EV leader is now under serious threat. In 2024, Tesla was able to bring in $97.69 billion in revenue still. According to the BrandValuer app has a brand worth an estimated $45.7 billion.

Ford’s EV Struggles

Ford has made notable investments into EVs, but it still lags far behind. In 2024, only 4% of its total global sales were electric vehicles. While the company has ambitious plans, scaling up has proven difficult. Ford faces fierce competition from both ends—premium EV makers like Tesla and value-driven juggernauts like BYD.

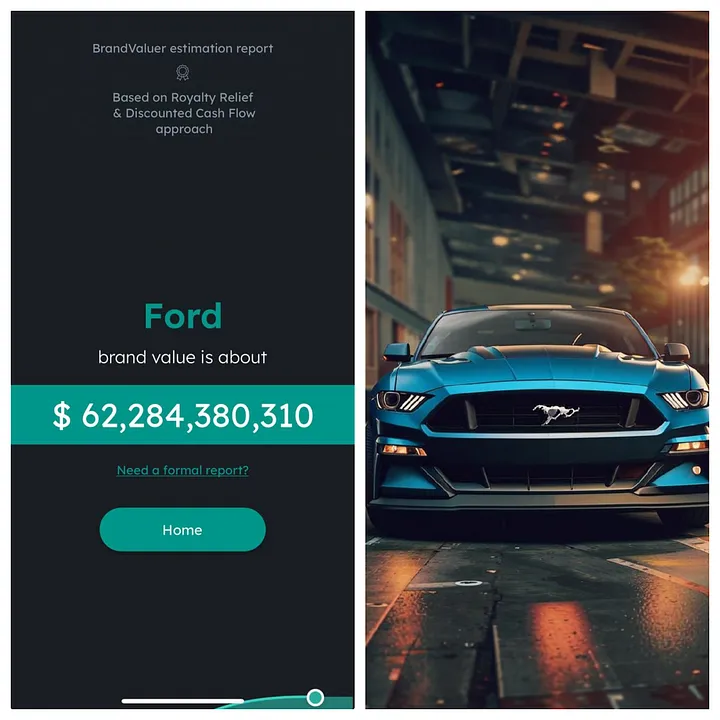

Ford’s challenge isn’t just product-related; it’s structural. Manufacturing costs, global supply chain issues, and slow adaptation to evolving EV tech have made it difficult for Ford to respond as swiftly as its Chinese counterpart. In 2024, Ford brought in $185 billion in revenue. According to the BrandValuer app has a brand worth estimate of $62 billion.

BYD’s Competitive Advantages

So what’s BYD doing differently?

- Vertical Integration: BYD produces over 70% of its own vehicle components, including critical parts like batteries and electronic control systems. This drastically reduces costs and improves quality control.

- Affordability: BYD has mastered the art of delivering high-performance, reliable EVs at prices that undercut competitors without sacrificing features.

- Global Manufacturing: The company is building new factories worldwide, including a massive facility in Brazil, as it continues its aggressive international expansion.

A Global Strategy That’s Working

BYD’s expansion into Europe has been particularly effective. Its vehicles are increasingly visible in Italy, Spain, the UK, and Nordic countries. It’s not just entering markets—it’s taking significant share.

Meanwhile, the company's strategy in emerging markets, like Brazil and Southeast Asia, is laying the foundation for long-term dominance, while competitors focus mostly on North America and Western Europe.

The Road Ahead

Tesla and Ford are not down for the count. Tesla is reportedly working on refreshed models and ramping up efforts to bring down production costs. Ford is investing heavily in next-gen battery tech and EV manufacturing plants. But time is of the essence.

BYD’s rise represents more than just a shift in market leadership—it’s a wake-up call for Western automakers. The EV era is global, fast-moving, and increasingly defined by value, scale, and innovation—areas where BYD is currently setting the pace.

If Ford and Tesla hope to reclaim or maintain their positions, they must adapt quickly. Because BYD isn’t just knocking at the door anymore—it’s already inside the house.